Managed Receivables

Quickly Scale or Launch Trade Account Purchasing

Outsource manual and cumbersome A/R processes so you can reduce costs and focus resources on growing your business.

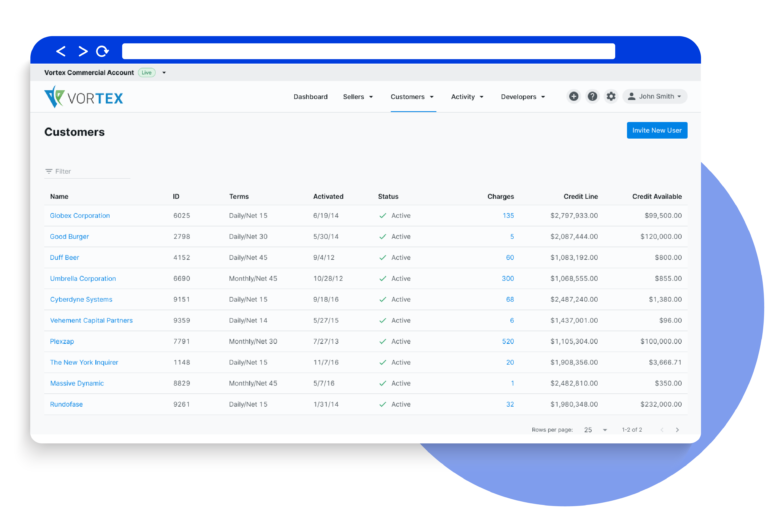

Credit Management

Outsource some or all of your Account Receivables with our end-to-end suite of technology and services.

Collections & Disputes

Eliminate collections and avoid late payments with our advanced technology backed by a dedicated team of TreviPay Collections experts.

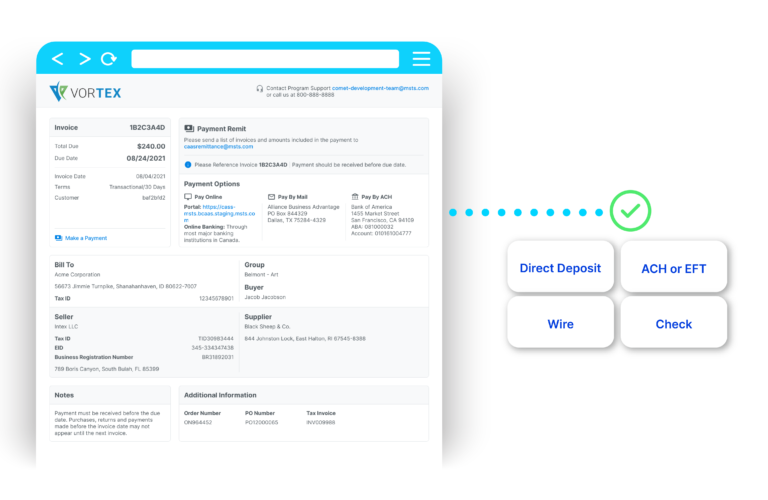

Cash Application & Reconciliation

Support complex buyer hierarchies, parent/child billing and all payment types on a TreviPay payment and invoicing network.

Growth Partner

Continually grow spending on your TreviPay network with the support of a dedicated TreviPay Customer Success team.

Credit Management

Enjoy higher average order volumes and greater lifetime value of client relationships based on trade credit, without the overhead and risk of managing receivables.

Collections & Disputes

Guaranteed settlement for you, no matter when your clients pay. TreviPay takes on full responsibility for the risk and time-consuming payment and collections process.

Cash Application & Reconciliation

Fast payment application ensures your buyers always have available credit for purchasing.

A Proven & Global Growth Partner

TreviPay has been supporting client growth for over 40 years and is the choice of premium brands around the globe.