Improve Working Capital Management with Back-Office A/R Automation

Outsource and Automate Accounts Receivables

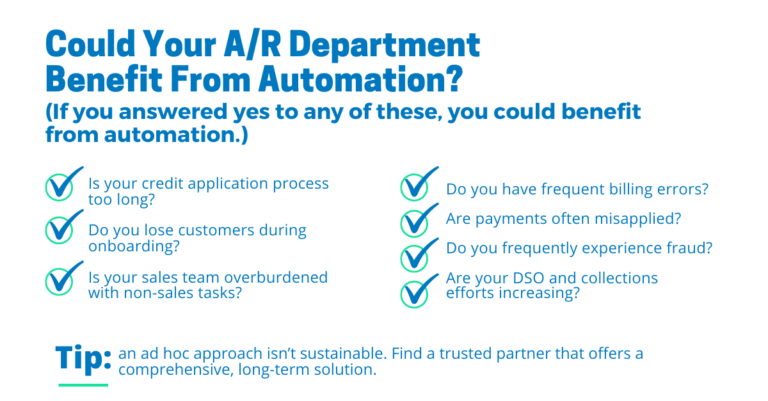

B2B payment leaders must focus on strategic accounts receivable automation and quality partnerships to optimize the digital payments experience, safely extend net terms, inspire long-term customer loyalty and improve working capital management.

With the right support and back-office innovation, A/R teams can be fully equipped for the future of payments.

The new data finds automation frees up working capital while improving accounts receivable workflows, human capital and the customer experience.

A few key findings:

- Chronic invoice and billing inaccuracies increase DSO and trap capital. Manual invoice data entry processes and unique billing requirements create a recipe for invoicing mistakes and further payment delays

- Inefficient administrative processes consume department time and resources. 63% of salespeople’s time is focused on activities other than selling — meaning only 37% of a sales team’s time is spent actually bringing in new business.

- A lack of time and capital degrades the customer experience. For over half of B2B finance employees (56%) it takes more than four days to onboard a new customer when providing net terms.

Download our new A/R automation and working capital management data report to learn more.

Download Now

PHA+VGhhbmsgeW91IGZvciBkb3dubG9hZGluZyBvdXIgZGF0YSByZXBvcnQuIFdlJ2xsIHNlbmQgeW91IHRoZSBmaWxlIHRvIGRvd25sb2FkIHZpYSBlbWFpbC48L3A+