The Architecture Of Accounts Receivable

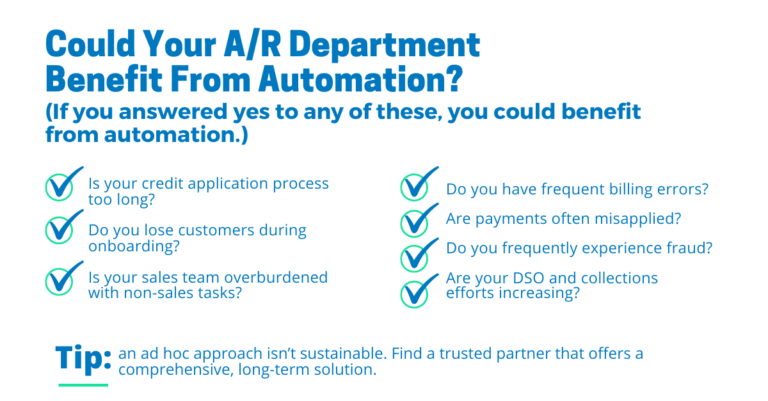

It’s not difficult for a supplier to tell when accounts receivable (A/R) processes are not optimized.

Late payments, invoice disputes and even fraud are all glaring red flags of A/R inefficiencies and friction.

But even when a business recognizes something has gone awry, pinpointing exactly what process has gone wrong — and how to fix it — is difficult. To optimize the AR process, businesses must deconstruct and reconfigure the entire architecture, TreviPay President Brandon Spear told PYMNTS’ Karen Webster. And the biggest opportunities for improvement occur at the beginning of the buyer-supplier journey.

“The customer onboarding process is a crucial step in optimizing AR, and it’s not receiving enough emphasis,” Spear said. “If it’s not done well, you set yourself up for failure down the road.”

Each misstep in onboarding is a catalyst to receivables failure later, he added, and optimization from the start means a wider opportunity for accelerated cash flows and stronger buyer-supplier partnerships.

A Trusted Relationship Between Buyers and Sellers

In a B2B relationship, establishing a new customer comes with a trove of complexities, from underwriting the client for credit, to establishing payment terms, to mitigating fraud risk.

Unfortunately, said Spear, many businesses fail to standardize and automate many of these processes.

To underwrite a new customer, manually aggregating and evaluating customer data is often a subjective and resource-heavy process, and it is an area in which AR makes the biggest mistakes.

“We see supplier-customer portfolios with credit limits that are five to 10 times higher than they should be,” he said. “Many sellers have a broken internal process to increase a credit line, so they set that limit as high as possible, so they don’t have to revisit the account later.”

Sky-high credit limits offer buyers an incentive to delay payment, even if a supplier establishes clear payment terms during the underwriting and onboarding processes.

Increasingly, Spear also said he’s seen a sudden influx of business identity fraud. The availability of public data on an existing company and its executives makes it extremely easy for fraudsters to impersonate a legitimate business with existing credit history, with the intention of purchasing goods they don’t plan on paying for, and then re-selling those products for profit.

“The proliferation of this available data makes the onboarding process even more crucial than it’s ever been — particularly if you’re selling something that’s got an after-market demand,” he said.

Invoice-to-Cash Optimization

Mitigating risk and establishing clear payment terms from the outset is only the beginning of the AR optimization process. Once a customer has been set up to make purchases, receive an invoice and send payment, there are more opportunities for a breakdown in the invoice-to-cash cycle.

Identifying which individuals within a buyer organization are authorized to make a purchase, which departments must receive bills, which portals buyers require to accept those invoices and what information must be included on documents becomes a monumentally resource-heavy task when suppliers are working with hundreds of customers. Yet managing this information is key to receiving payment.

“Bigger players, in particular, will have a policy where if you don’t put an invoice in their particular portal, they’re simply not paying you,” said Spear. “You could have a couple hundred portals that you have to go into every time to submit your invoice, and if you don’t do that, you’re unlikely to get paid on time.”

Receiving timely payment isn’t the end of the AR optimization journey, however.

Depending on the complexity of a purchase, suppliers continue to face hurdles in how the payments are remitted and reconciled. Spear explained that in simple transactions, a high volume of low-value purchases often leads a buyer to providing a large lump sum for multiple invoices with limited remittance advice, creating friction for a supplier to understand how to apply that cash to which particular invoices. In complex transactions, reconciliation friction is linked to the burden of ensuring contract agreements are adhered to and invoice line items are correct and resolving disputes.

“You typically see a blend of these two extremes: how much reconciliation you’re doing, and how important remittance advice is for application of cash when payment is received,” said Spear, adding that with ACH there is a limited amount of remittance data that can be included with the payment, pushing buyers to continue to rely on resource-heavy checks to submit this information.

Read the full article on PYMNTS.com.